By Thomas Parker December 10, 2025

These days, a good point-of-sale system for Delaware retailers is necessary in a highly competitive market. Even if Delaware has no sales tax statewide, the different rates for lodging, alcohol, and prepared foods, for example, still need to observe the point-of-sale tax rules and regulations very strictly. Retailers need to handle sales taxes accurately in order to be compliant with the tax laws on retail sales in Delaware. Today’s POS systems maximize the benefits of such tax-wise and finance-wise operations through the automation of tax calculations, tracking of exemptions, production of detailed reports, and linking with accounting software.

The ushering in of a strong POS system leads to less human error, faster transactions, and the retailers always being compliant with Delaware’s regulatory framework. An effective POS system will also present retail owners with sales trends, inventory status, and tax liability insights, which will facilitate their decision-making process as they want to be strategic. With the retail industry turning more technological, using a POS system designed for Delaware would mean that your operation would be efficient forever, customer satisfaction would be improved, and compliance risks would be reduced. For retailers, the correct POS system is not merely a checkout tool—it is a strategic business solution that backs up financial accuracy, regulatory compliance, and sustainable growth.

Why POS for Delaware Retailers is Critical for Sales Tax Handling

The selected POS for Delaware retailers is essential to the accurate handling of sales taxes. Even though there is no general sales tax in Delaware, several items, including alcohol, prepared food, and lodging, are subject to point-of-sale tax rules and thus are taxed. The retailers must acquire a POS system that not only automatically computes these taxes but also applies the exemptions wherever necessary, thus supporting the retailer’s tax compliance in Delaware. Computation done manually can result in errors, penalties, and displeased customers. A case in point is a minor retail shop dealing in liquor that should maintain comprehensive records of excise taxes; otherwise, it might be subjected to severe fines as a consequence.

Delaware’s modern POS systems help retailers manage very difficult, complex tax scenarios such as split transactions and multi-item exemptions. Moreover, the accuracy of reporting has the power to prevent businesses from throwing away their money through misfiling, hence, avoiding lawsuits or tax audits. Besides, the POS also contributes to the company’s operational efficiency by speeding up the checkout process, hence allowing the staff to attend to customers rather than do manual tax calculations. In the long run, the investment in a dedicated POS for Delaware Retailers is a guarantee of a trouble-free shopping experience, a decline in compliance risks, and improved financial control over all retail operations.

Also Read: Navigating Delaware Payment Processing: Trends, Tips, and Insights for Success

Key Features of POS for Delaware Retailers for Effective Tax Management

A robust POS for Delaware retailers incorporates features designed to simplify sales tax handling while ensuring strict Delaware retail tax compliance. The automatic tax calculation is one of the key features, which precisely applies taxes to all taxable items, even to particular categories like alcohol, lodging, and prepared foods. This not only reduces the likelihood of human errors but also guarantees compliance with the point-of-sale tax regulations. Furthermore, the retailers have the option to set up exemptions for those customers or products that qualify, thus rendering the process effortless and quick.

Another significant feature is the provision of detailed reporting, which gives an indication of the nature of sales that are taxable and non-taxable, so that the business owner can look at the trends, get ready for the audit, and keep the records updated for Delaware retail tax compliance. The connectivity to the accounting software keeps the sales, inventory, and tax data uniform, and hence, the financial management is simplified.

Other functionalities that make the POS systems for Delaware retailers more capable include:

- Cloud-based backups for secure data storage.

- The point-of-sale tax rules update in real time.

- Dashboards that can be customized for easy tax tracking.

- Automated notifications for taxation mismatches or unusual activities.

Consequently, if Delaware merchants have these functionalities at their disposal, they would not only be able to compute sales tax accurately but also minimize the associated operational risk and maintain the necessary openness, which would consequently make the POS system for Delaware retailers a must-have device for modern-day retail activities.

How POS for Delaware Retailers Simplifies Sales Tax Handling

For Delaware retailers, POS for Delaware retailers streamlines sales tax handling by automating every step of the process. Taxable items, exemptions, or mixed-rate products calculations are very lengthy and could easily lead to mistakes. Nevertheless, real-time accurate tax rates are being applied by modern POS systems automatically, so products like alcohol, prepared foods, or lodging are taxed based on the point-of-sale tax rules.

Furthermore, tax automation lessens the burden of record-keeping and reporting for retailers, and so they are able to adhere to the retail tax compliance standards in Delaware easily. The entire process of every transaction is documented and classified, thus creating an audit trail that not only makes filing easier but also minimizes the chances of incurring penalties. Moreover, alerts and notifications for tax updates or discrepancies add to the accuracy improvements.

The main advantages of a POS system in relation to sales tax handling are:

- Automated calculation of taxes for multiple product categories.

- Error decrease and compliance guarantee.

- Immediate tax notifications and alerts concerning regulatory changes.

- Easier reporting for audits and financial review.

- Customer trust increased with the right taxation.

Automated systems combined with POS for Delaware Retailers make it possible for the employees to devote their time to customer service and still keep the sales tax handling transparent and accurate, thus raising the overall operational efficiency and compliance.

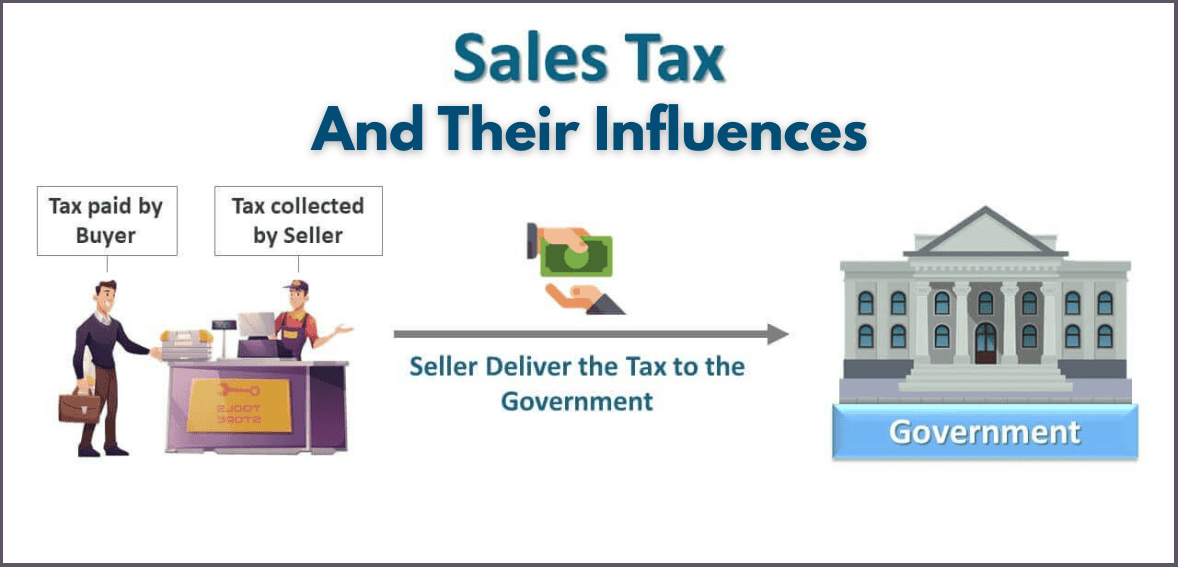

Delaware’s Point of Sale Tax Rules and Their Influence on Retailers

Even though Delaware does not impose a general sales tax, point-of-sale tax rules still apply for some items like alcohol, prepared foods, hotels, and some other categories of special products. Comprehending these rules is very important not only to keep Delaware retail tax compliance but also to avoid fines, audits, or damage to customer relations.

Installing a properly set up POS for Delaware retailers makes sure that these rules are applied very strictly, that is, automatically separating the taxable items from the non-taxable goods and calculating the taxes for those customer products that are liable to pay them. Reports created by the POS will also provide a very clear and concise record of compliance, thus helping retailers prove that they were indeed following the point-of-sale tax rules very strictly.

Retailers should bear in mind:

- The alcohol and excise taxes applied must be accurate at the sale counter.

- Different sales tax rates may apply to prepared foods depending on the place and the category of the product.

- Lodging taxes must be collected at the time of payment.

- Certain customers or products should receive exemptions automatically.

- Compliance verification will be done easily with accessible reports and audit trails.

Delaware retailers will be able to utilize a well-structured POS system to cope with these regulations in a very efficient manner, to get the sales tax management accurate, and to carry out the operations uninterrupted while observing the retail tax compliance requirements of Delaware.

Integrating POS for Delaware Retailers with Inventory and Accounting

Connecting the various systems is the first step to optimizing the use of POS for Delaware retailers in the matter of sales tax handling. The union of POS with the inventory management system will guarantee proper monitoring and immediate updates of the taxable products. To illustrate, when sales of alcoholic beverages or ready-to-eat meals occur, the inventory will be adjusted instantly, and the tax calculated correctly according to the stock currently available.

The integration of accounting software not only reduces the complexity of the tasks but also does so by automatically categorizing sales into taxable and non-taxable, and thus applying the point-of-sale tax rules consistently. Retailers can create extensive reports for audits or internal assessments without the need for manual reconciliation.

The main advantages of integration comprise:

- Up-to-the-minute inventory tracking leading to precise tax calculation.

- Accounting reconciliation is being done automatically, delivering financial openness.

- Product profitability and tax liabilities are being revealed.

- Manual work and operational mistakes are being cut down.

- Meeting Delaware retail tax compliance measures.

All the above-mentioned advantages of integrated systems have resulted in better efficiency, reduced errors in sales tax handling, and more accurate and transparent records throughout all the business operations of the retailers in Delaware.

Common Challenges in Sales Tax Handling at POS for Delaware Retailers

Despite advanced POS for Delaware retailers, retailers may face challenges in sales tax handling. Without automation, manual entry errors are still a major risk factor for companies. Errors in product classification might lead to discrepancies since, under point-of-sale tax rules, different products could be taxed at different rates. Moreover, government agency updates require immediate changes in the system; otherwise, the retailer might be non-compliant.

Along with these, the following challenges arise:

- Multi-location consistency: Different stores may have varying local requirements.

- Staff training: The misuse of exemptions or tax rates will occur because of the staff’s lack of knowledge.

- System maintenance: To keep the POS compliant, updates are to be done regularly.

- Product complexity: Special items such as alcohol or prepared foods need very accurate tax handling.

- Audit preparedness: It is crucial to always have proper records and compliance reports.

A robust POS system for Delaware retailers, along with thorough training and proper procedures, will reduce these difficulties and also be the means for the correct sale tax handling and compliance with retail tax in Delaware throughout the entire area.

Training Staff to Use POS for Delaware Retailers Effectively

Training staff is vital to maximize the benefits of POS for Delaware retailers in sales tax handling. Staff should get familiar with the point-of-sale tax rules and exemptions, and also be able to create compliance reports. Continuous training will inform personnel about different product categories, system changes, and regulations, which will help in maintaining correct tax calculations.

Key staff training practices include:

- Step-by-step POS system tutorials for daily operations.

- Scenario-based training on handling taxable and exempt items.

- Guidance on how to produce and interpret tax reports for compliance purposes.

- Minor POS issues troubleshooting and forwarding complex issues to higher authority.

- Updating on regulatory changes to keep up with Delaware retail tax compliance.

Staff who are properly trained contribute to the efficiency of the operations, the decrease of errors, and the provision of quicker and more accurate customer service. Retailers investing in training make sure their POS for Delaware retailers is operating at the highest possible efficiency, which means proper handling of sales tax and smooth business operations.

Future Trends in POS for Delaware Retailers and Tax Compliance

The future of POS for Delaware retailers is progressing towards automation, intelligence, and cloud-based capability. Tax compliance tools powered by AI are coming to the forefront to estimate tax liabilities, spot inaccuracies, and give suggestions for the best sales tax handling. The use of cloud-based systems allows monitoring of transactions and taxes in remote locations, thus keeping the rules of POS tax application consistent across different places.

The main trends defining the future are:

- AI integration: Predictive tax management and anomaly detection.

- Mobile POS systems: Ability to check out anywhere while staying compliant.

- Regulatory updates: Automatically taking care of the latest tax compliance in Delaware retail.

- Connection with inventory and accounting systems: Instant access and faster processing.

- Cloud-based platforms that can grow with your business: Multi-location operations and support for larger businesses.

POS systems suitable for the future of Delaware retailers will bring benefits such as operational efficiency, tax handling accuracy, and a growing position in the retail environment of the future.

Conclusion

An efficiently operating POS for Delaware retailers’ system is paramount for the correct treatment of sales tax, the smooth running of the business, and compliance with Delaware retail tax regulations. Modern POS solutions begin with automatic tax calculation and exemption handling to offer detailed reporting and integration with accounting systems, thus making the understanding of very complex regulatory requirements easier.

POS for Delaware retailers can, together with the tax rules for point of sale and advanced POS technology, reduce mistakes, speed up their processes, and keep the trust of their customers. In addition, going for a future-proof POS system produces data on the inventory, sales trends, and tax obligations that are supportive of making better business decisions. The investment in a sturdy POS system for Delaware Retailers will comply with the laws and be effective, allowing for tremendous growth, which is why this investment is a strategic move for long-term success in Delaware’s peculiar retail environment.

FAQs

What is the significance of a POS system for retail stores in Delaware?

A POS system takes care of the taxes with accuracy, keeps Delaware retail tax compliance by automating the payment process, and monitors stock, all lead to producing in-depth reports. It minimizes mistakes, cuts down time, and, alongside retailers, collaborates efficiently with point-of-sale tax rules.

In what manner does a POS system manage the tax regulations particular to Delaware?

POS systems make it easy to determine the exact tax amount for several products, such as alcohol, ready-to-eat foods, and lodging, grant the benefits, and keep records for taxation purposes. Automated notifications play the role of a reminder and guarantee that the point-of-sale tax rules are adhered to all the time.

Can accounting software be used in conjunction with a POS system?

Yes, it can be used. Through integration, it is possible to have the same data concerning sales, taxes, and inventory throughout the systems, which in turn eases the tasks of reporting, reconciling records, and supporting Delaware retail tax compliance.

What difficulties do Delaware merchants encounter concerning sales tax processing?

Among the difficulties faced are errors from manual calculations, wrong product categories, continuous changes in the law, different locations having different rules, and personnel learning. A modern POS for Delaware retailers can significantly reduce these issues.

Is there any futuristic trend for the POS systems used in the retail sector in Delaware?

Definitely. The trend that is emerging is the POS systems based on the cloud, tax management driven by AI, mobile payment, automatic regulatory updates, and reporting that is integrated. These trends not only make the sales tax handling easier but also help to keep the retail tax compliance in Delaware smooth.